ABOUT

AlphaOps®

We are investment operations consultants offering strategic advice and tailored solutions to hedge funds, private equity funds, family offices and other investment managers.

We are investment operations consultants offering strategic advice and tailored solutions to hedge funds, private equity funds, family offices and other investment managers.

Stamford, CT

Our team of experienced professionals offers all the benefits of an experienced operating team without the cost burden.

Our approach is grounded in common sense management, trusted advise, and operational strength that leads to alpha.

What

WE DO

We provide a range of services to investment funds, including advisory solutions, managed middle office services, private equity fund administration, and cloud technology

We help you build a best-in-class front, middle, and back-office platform to reduce the risk of operational failure, reduce implementation and ongoing operating costs and increase efficiency and productivity. We position you to do what you do best: raise, invest and manage client capital.

We are operational efficiency experts with decades of experience launching, operating and growing world-class alternative asset management companies. We provide tailored solutions around the CFO, COO, CCO, and CTO functions to help your people and technology work efficiently and effectively for you.

We serve owners, principals, portfolio managers and C-Suite teams managing alternative asset management firms. We provide launch services to new managers as well as growth and operational improvement services for established managers.

What We Do

Generate operational alpha

We help you build a best-in-class front, middle, and back-office platform to reduce the risk of operational failure, reduce implementation and ongoing operating costs and increase efficiency and productivity. We position you to do what you do best: raise, invest and manage client capital.

How We Do It

Experience matters

We are operational efficiency experts with decades of experience launching, operating and growing world-class alternative asset management companies. We provide tailored solutions around the CFO, COO, CCO, and CTO functions to help your people and technology work efficiently and effectively for you.

Who We Serve

Investment managers

We serve owners, principals, portfolio managers and C-Suite teams managing alternative asset management firms. We provide launch services to new managers as well as growth and operational improvement services for established managers.

We help you generate

Operational Alpha

Operational alpha is an institutional quality operating platform leveraging best practice standards and modern technology. Aims to right-size operating costs, improve efficiency and productivity, and reduce risk of failure. Enables decision-makers to focus on core competencies and achieve excess returns.

Challenges faced by decision-makers:

Decision-makers get bogged down in the daily operational tasks, hindering their ability to add value through strategic decisions. Involvement in the daily operational tasks limits decision-makers ability to maximize returns and strategic impact.

Introducing AlphaOps:

The solution to unleashing operational alpha by delegating middle/back-office tasks to a highly efficient team.

Key features of AlphaOps:

Streamlined Operations, Scalable Support, Robust Technology Solutions, Compliance Support, and Experienced Team.

By leveraging AlphaOps, decision-makers can focus on strategic decisions, maximize returns, and achieve greater impact, while delegating operational tasks to a capable and experienced team.

Unlocking Operational Alpha: Empowering Decision-Makers for Optimal Performance.

Operational weakness leads to

FAILURE

Operations can prevent great managers from achieving their true business potential

Typical Operating Activities

- Investing

- Risk monitoring & management

- Investment operations

- Fund accounting & administration

- Investor accounting

- Investor relations & servicing

- Technology

- Cybersecurity & privacy

- Legal & compliance

- Due diligence

- Valuation

- Regulatory

- Tax reporting & delivery

- Firm administration & human resources

Common Issues

- Unauthorized investments, errors

- Failure to monitor and manage costs

- Poor data quality, incorrect data, operating inefficiencies increases costs

- Lack of transparency

- NAV errors

- Investor reporting issues

- Failure to comply with general solicitation rules

- Inefficient use of technology, legacy systems

- Rising legal fees, fraud, embezzlement & theft

- Conflicts of interests, side letters

- Segregation of duties, mispriced assets

- Missed filings, incorrect filings, incorrect regulatory report submissions

- Poor hiring practices (under/overstaffed)

- Unethical and dishonest employees

Managers Are Challenged With The Need To Establish An Institutional Quality Infrastructure While Simultaneously Generating Alpha.

Operational strength leads to

ALPHA

Experience Matters

We have been on the front line making difficult operating decisions for fast paced multi-strategy businesses, and at times, during difficult market cycles.

We have first-hand experience establishing, developing and operating multibillion-dollar alternative asset management businesses.

We have decades of experience launching and operating world-class alternative asset management businesses.

We didn't just join an operating team of an established alternative asset management business, we were instrumental in building these businesses up from concept, development, and through to thriving global businesses.

Our Expertise Can Deliver Operational Alpha So You Can Focus Your Time On What You Do Best: Raise, Invest And Manage Client Capital.

Operational Alpha

BENEFITS

Experience Matters

Cost savings

Uncovering hidden savings and efficiency gains

Cloud adoption

Cloud technology adoption is the cost savings competitive advantage

Focused decision-making

Principals recapture time to focus on research and alpha generation

Aligned interests

Front/middle/back office are now more aligned than ever

Reduces risk

Improved process controls lowers chances of operational failure

Optimize Your Operations, Unleash Your Alpha.

MEET OUR

Experts

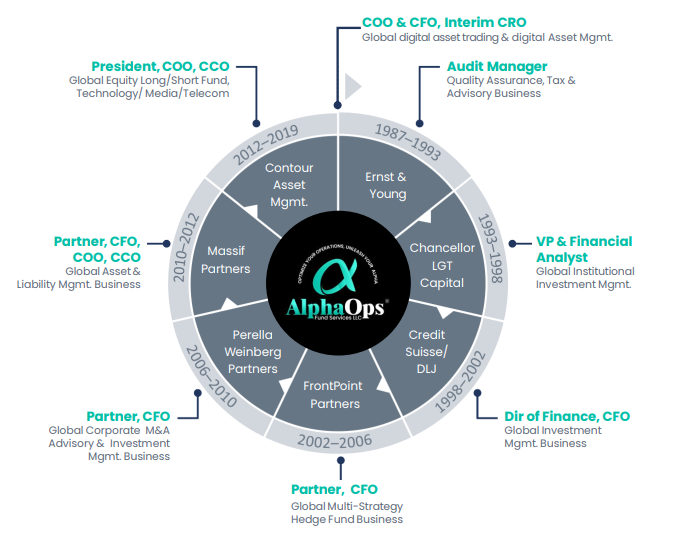

Julio Garcia, CPA

CEO & Founding Partner

julio@alphaops.io

Julio Garcia is a highly accomplished executive with a distinguished career in the alternative asset management industry. With first-hand experience in establishing, developing, and operating multi-billion dollar businesses, Julio has consistently demonstrated his expertise in driving operational efficiency and fostering growth.

As an operational efficiency expert, Julio’s strategic vision and hands-on approach have consistently driven success and growth in the alternative asset management industry. His commitment to building and nurturing thriving global businesses sets him apart as a true leader in the field.

Julio’s exceptional leadership skills and track record of success have been honed through key roles at renowned organizations such as Menai Financial Group, Contour Asset Management, Massif Partners, Perella Weinberg Partners, and FrontPoint Partners. He has also held executive positions at prestigious institutions like Credit Suisse AM, DLJ Merchant Banking, Chancellor LGT, and Ernst & Young.

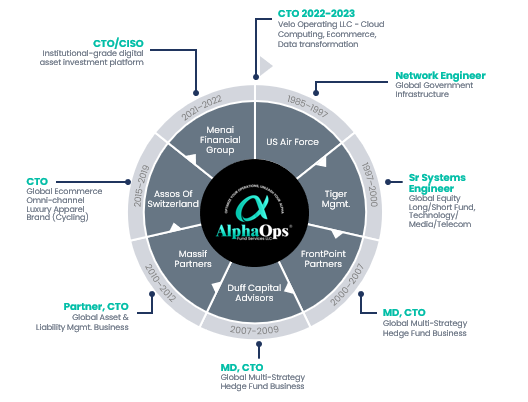

Lance Edwards

CTO & Founding Partner

lance@alphaops.io

Lance D. Edwards is an influential Senior Technology Executive and Management Consultant with 30+ years of expertise in information technology management, business development, and application development. He excels at spearheading operational strategies that drive organizational growth and leverage emerging technologies.

As the CTO/CISO and Head of IT Platform at Menai Financial Group, Lance implemented a strategic plan for global technology operations and security, ensuring a robust infrastructure for digital asset investments and trading services.

As the Managing Director and Chief Technology Officer at Assos of Switzerland GmbH, Lance led a significant technological transformation, transitioning the company to an Omni Channel eCommerce model in the cloud, driving operational efficiency and performance.

In earlier roles at Massif Partners LLP, Duff Capital Advisors LLC, FrontPoint Partners LLC, Alpha Investment Management, and Tiger Management, Lance played a crucial role in designing and integrating global technology platforms.

AlphaOps®

Julio Garcia, CPA

- Julio is an accomplished, hands-on Chief Financial Officer, Chief Operating Officer and Chief Compliance Officer with decades of proven leadership skills and a strong track record of building successful world class global asset management businesses.

- Prior to founding AlphaOps, Julio was Chief Operating Officer, Chief Financial Officer and Interim Chief Risk Officer at Menai Financial Group, a Global digital asset trading firm (market maker) and digital asset management firm from November 2020 to December 2022.

- Prior to Menai Financial Group, Julio was a Founding Partner at FLSV Fund Consulting Services (FCS), an investment operations consulting firm from April 2020 to November 2020.

- Prior to joining FCS, Julio was President, Chief Operating Officer and Chief Compliance Officer at Contour Asset Management, a Global equity long/short hedge fund focused on technology, media and telecommunications (“TMT”) from September 2012 to December 2019.

- From 2010 to 2012, Julio was a Partner, Chief Operating Officer and Chief Financial Officer of Massif Partners, a Global asset and liability management business.

- From 2006 to 2010, Julio was a Partner and Chief Financial Officer of Perella Weinberg Partners Group LP, a Global corporate M&A advisory and investment management business.

- From 2002 to 2006, Julio was a Partner and Chief Financial Officer at FrontPoint Partners LLC., a Global multi-strategy hedge fund business.

- Julio also held executive positions at Credit Suisse Asset Management, DLJ Merchant Banking’s Controllers’ Group, Chancellor LGT Capital Management and Ernst & Young from 1987 to 2002.

- Julio received a B.S. in Accounting from Mercy College and is a Certified Public Accountant in the State of New York.

AlphaOps®

Lance Edwards

- Lance D. Edwards is a highly influential Senior Technology Executive and Management Consultant with over 30 years of experience in information technology management, business development, and application development across various industries. He is skilled in leading operational strategies, driving organizational growth, and leveraging emerging technologies.

- In his most recent role as the Outsourced CTO for Velo Operating LLC (June 2022 to April 2023), a company specializing in cloud computing and ecommerce, Mr. Edwards optimized their online operations and implemented robust digital commerce solutions.

- Prior to that, he served as the CTO/CISO and Head of IT Platform at Menai Financial Group (July 2021 to March 2022), a leading provider of digital asset investment products and trading services. He played a crucial role in establishing a strategic plan for global technology operations and security.

- From 2015 to 2019, Mr. Edwards was the Managing Director and Chief Technology Officer at Assos of Switzerland GmbH, where he led a significant technological transformation, transitioning the company to an Omni Channel ecommerce model in the cloud and driving operational efficiency and performance.

- Earlier in his career, he held key positions such as Partner and Chief Technology Officer at Massif Partners LLP and Managing Director and Chief Technology Officer at Duff Capital Advisors LLC, both located in Greenwich, Connecticut. His contributions to designing and integrating global technology platforms were instrumental at these firms.

- From 2001 to 2007, Mr. Edwards served as the Managing Director and Chief Technology Officer at FrontPoint Partners LLC in Greenwich, Connecticut, where he was recognized for his technological vision and leadership. Prior to that, he held positions at Alpha Investment Management and Tiger Management in New York, New York.

- Throughout his career, Lance D. Edwards has demonstrated expertise in project management, strategic planning, business reengineering, and enterprise resource integration. His extensive experience and proficiency have made him a respected figure in the technology sector.

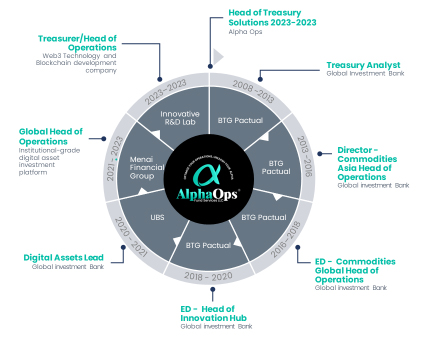

AlphaOps®

Lucas Lemos

- Lucas is an accomplished, hands-on Operator with 2 decades delivering high efficiency and quality financial business. His edge lies on the application of technology to enhance, scale and consolidate business models. In the last 6 years, has been in leadership positions exploring and developing the Digital Assets ecosystem and has achieved impressive results.

- In his most recent role as Treasurer and Head of Operations for Protocol Labs European expansion, Lucas has implemented and developed a direct market access treasury trading business, based on the most secure and scalable technologies in the market. Now is optimizing the business trading capabilities, enabling direct market access, and algo trading structure to the business portfolia

- Prior to that, he served as the Global Head of Operations, at Menai Financial Group (Sep 2021 to July 2023), a leading provider of digital asset investment products and trading services. Implemented a highly scalable operational structure and a lean team that executed Menai’s Market Making business 24/7 without failures.

- From 2020 to 2021, Lucas has lead UBS Treasury Digital Assets program, developing UBS’s Digital Assets Custody solutions, internal stable coins to enable digital settlement in blockchain and launch UBS’s first digital bond, around 375mm CHF at SDX and SIX (Switzerland Exchanges).

- Earlier in his career, Lucas became a strong leader of one of Brazil’s larger investment Bank, where he spent 13 years of his career. Managed Fixed Income Treasury (Sao Paulo – Brazil – 2009/2013), launched BTG’s Commodities business in Asia (Singapore – 2013 (2016), expanded his role as global head of operations from 2016 2018. Finally, Managed BTG’s Innovation Hub in London becoming responsible for BTG’s Digital retail banking and SME lending programs.

- From 2016 to 2019, Lucas founded his own start up building blockchain technology, aiming to launch the first EUR FCA regulated stable coin, custodial services and also an OTC trading marketplace for crypto institutional investors.

- Lucas is now is based in London and leading Alpha Ops European and Asian expansion.